Thu Oct 28 02:53:23 2021

— Sixteenth Amendment to the United States Constitution

— The Sixteenth Amendment (Amendment XVI) to the United States Constitution allows Congress to levy an income tax without apportioning it among the states on the basis of population. It was passed by Congress in 1909 in response to the 1895 Supreme Court case of Pollock v. Farmers’ Loan & Trust Co. The Sixteenth Amendment was ratified by the requisite number of states on February 3, 1913, and effectively overruled the Supreme Court’s ruling in Pollock.

Prior to the early 20th century, most federal revenue came from tariffs rather than taxes, although Congress had often imposed excise taxes on various goods. The Revenue Act of 1861 had introduced the first federal income tax, but that tax was repealed in 1872. During the late nineteenth century, various groups, including the Populist Party, favored the establishment of a progressive income tax at the federal level. These groups believed that tariffs unfairly taxed the poor, and they favored using the income tax to shift the tax burden onto wealthier individuals. The 1894 Wilson–Gorman Tariff Act contained an income tax provision, but the tax was struck down by the Supreme Court in the case of Pollock v. Farmers’ Loan & Trust Co. In its ruling, the Supreme Court did not hold that all federal income taxes were unconstitutional, but rather held that income taxes on rents, dividends, and interest were direct taxes and thus had to be apportioned among the states on the basis of population.

For several years after Pollock, Congress did not attempt to implement another income tax, largely due to concerns that the Supreme Court would strike down any attempt to levy an income tax. In 1909, during the debate over the Payne–Aldrich Tariff Act, Congress proposed the Sixteenth Amendment to the states. Though conservative Republican leaders had initially expected that the amendment would not be ratified, a coalition of Democrats, progressive Republicans, and other groups ensured that the necessary number of states ratified the amendment. Shortly after the amendment was ratified, Congress imposed a federal income tax with the Revenue Act of 1913. The Supreme Court upheld that income tax in the 1916 case of Brushaber v. Union Pacific Railroad Co., and the federal government has continued to levy an income tax since 1913.

— Financial crisis of 2007–2008

— The financial crisis of 2007–2008, also known as the global financial crisis (GFC), was a severe worldwide economic crisis. Prior to the COVID-19 recession in 2020, it was considered by many economists to have been the most serious financial crisis since the Great Depression. Predatory lending targeting low-income homebuyers, excessive risk-taking by global financial institutions, and the bursting of the United States housing bubble culminated in a “perfect storm”. Mortgage-backed securities (MBS) tied to American real estate, as well as a vast web of derivatives linked to those MBS, collapsed in value. Financial institutions worldwide suffered severe damage, reaching a climax with the bankruptcy of Lehman Brothers on September 15, 2008 and a subsequent international banking crisis.The preconditions for the financial crisis were complex and multi-causal. Almost two decades prior, the U.S. Congress had passed legislation encouraging financing for affordable housing. In 1999, the Glass-Steagall legislation was repealed, permitting financial institutions to cross-pollinate their commercial (risk-averse) and proprietary trading (risk-seeking) operations. Arguably the largest contributor to the conditions necessary for financial collapse was the rapid development in predatory financial products which targeted low-income, low-information homebuyers who largely belonged to racial minorities. This market development went unattended by regulators and thus caught the U.S. government by surprise.After the onset of the crisis, governments deployed massive bail-outs of financial institutions and other palliative monetary and fiscal policies to prevent a collapse of the global financial system. The crisis sparked the Great Recession which resulted in increases in unemployment and suicide and decreases in institutional trust and fertility, among other metrics. The recession was a significant precondition for the European debt crisis.

In 2010, the Dodd–Frank Wall Street Reform and Consumer Protection Act was enacted in the US as a response to the crisis to “promote the financial stability of the United States”. The Basel III capital and liquidity standards were also adopted by countries around the world.

— Usury

— Usury () is the practice of making unethical or immoral monetary loans that unfairly enrich the lender. The term may be used in a moral sense—condemning, taking advantage of others’ misfortunes—or in a legal sense, where an interest rate is charged in excess of the maximum rate that is allowed by law. A loan may be considered usurious because of excessive or abusive interest rates or other factors defined by the laws of a state. Someone who practices usury can be called an usurer, but in modern colloquial English may be called a loan shark.

In many historical societies including ancient Christian, Jewish, and Islamic societies, usury meant the charging of interest of any kind was considered wrong, or was made illegal. During the Sutra period in India (7th to 2nd centuries BC) there were laws prohibiting the highest castes from practicing usury. Similar condemnations are found in religious texts from Buddhism, Judaism (ribbit in Hebrew), Christianity, and Islam (riba in Arabic). At times, many states from ancient Greece to ancient Rome have outlawed loans with any interest. Though the Roman Empire eventually allowed loans with carefully restricted interest rates, the Catholic Church in medieval Europe, as well as the Reformed Churches, regarded the charging of interest at any rate as sinful (as well as charging a fee for the use of money, such as at a bureau de change). Religious prohibitions on usury are predicated upon the belief that charging interest on a loan is a sin.

(*67e9b79f*):: We could “drain the swamp”

We could “arrest the cabal”

And if we left USURY in place,

The cabal, and the swamp, would be back in business without missing a beat.

The cabal, and the swamp, were able to gain power and influence thru usury.

Usury is the charging of money, for the use of money

Usury is legally defined as charging more interest than is allowed BY LAW.

Jimmy Carter deregulated usury, because poor people needed more DEBT.

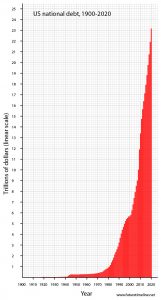

Usury has an insatiable appetite, and it always starts slow, turns a corner, and “goes asymptote”, or as they say “to the moon”

Right now we are in the vertical asymptote part of the curve, which is the part just before the big crash.

The crash will happen. That is a certainty.

But how we react to that crash, will be the legacy we leave our children

We NEED to outlaw USURY, at any rate.

All money is to be lent at 0.00% interest.

Any interest rate above 0.00% is a felony punishable by 5 years in prison.

USURY is the way that “the man” skims all of the wealth off of the working people.

ALL WEALTH is derived from LABOR.

And yet, the laborers hardly have anything!

Where does the wealth go?

The wealth is taken from the worker, in the form of income taxes on his paycheck.

Those income taxes go to pay USURY, which is the interest on the so-called “national debt”

The federal income tax was put into place around 1913, which is the same time the Federal Reserve and IRS came into existence.

They had to pass the 16th CONSTITUTIONAL AMENDMENT in 1906 to be able to tax the US workers

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

We need to repeal the 16th amendment, or better yet, amend the amendment, to specifically FORBID the US Congress from having the power to lay or collect taxes on incomes, from whatever sources derived…

Wealth is “redistributed” from the worker, to the bank, in the form of USURY.

The worker pays interest on a mortgage, and interest on a car loan, and interest on credit cards, and interest on student loans,

The worker pays USURY when he pays property taxes on his home, if that money goes to pay interest on bonds.

The USURY of the Federal Reserve is the mechanism by which the Rothschild and Rockefeller et al took over control of the US government, and the American people.

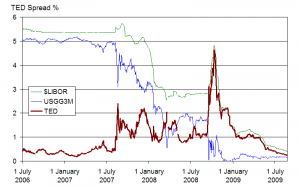

Some of you don’t remember, but back in 2008 there was a HUGE banking crisis,

And at that time, the bankers ‘metaphorically’ held a gun to Nancy Pelosi, and the bankers demanded something like $700Billion in taxpayer money. When asked about how they came up with that number, Pelosi replied that “they needed a really big number”

At that time, USURY had already run its course, and was on the verge of collapse,

The bankers frantically tried to ‘correct’, by lowering the USURY rate down lower, and lower, until it was almost at 0%

The reason the bankers kept lowering the rate, was because the internet kept talking about USURY.

So by lowering the interest rate to near 0%, the bankers were able to take USURY debate off the table, while remaining in power, playing the long game.

Recently, the Federal Reserve has been raising interest rates, because, paraphrase, they merely wanted to set interest rates to be closer to where they have traditionally been.

“Traditionally”, interest rates have been used to skim the wealth from the working people.

The Federal Reserve doubled interest rates!

And then, the Federal Reserve doubled interest rates again!

We are still paying interest on the debts incurred to fight World War 1, and World War 2, and every other conflict up to today.

We buy wars on credit.

“Nothing can stop what is coming”

what is coming, is a super crash.

But the people, the usurers, who are responsible for the crash, of course will want to remain in power after the crash. They have become accustomed to the lifestyle, and will do anything to maintain that lifestyle.

USURY is how they all came to power,

And ABOLISHING USURY is how they will be permanently removed from power.

End The Fed

End The IRS

Abolish Usury

(*212c3007*):: What if we taxed the Fed at 0.006% +public!