status: public

Sun Aug 1 13:36:32 2021

(*8cd8d197*)::

Unlike past scares, Monday’s report of a Department of Justice investigation hasn’t shaken traders’ faith in the stablecoin.

(*8cd8d197*)::

According to one analyst, some $1 billion in trading positions were liquidated as prices surged.

— USDT Maintains Dollar Peg as Traders Shrug Off DOJ Tether Probe Report – CoinDesk

— Unlike past scares, Monday’s report of a Department of Justice investigation hasn’t shaken traders’ faith in the stablecoin.

(*8cd8d197*)::

Market analysts say Monday’s price gains accelerated amid a short squeeze.

(*8cd8d197*)::

Possible criminal charges against Tether executives will put even more pressure on a product that the market is already cooling on.

— Bitcoin Spikes on Short Squeeze, Shrugs Off Tether News – CoinDesk

— Crypto market analysts say the latest spike in the price of bitcoin ($BTC) may have been fueled by a short squeeze.

(*8cd8d197*)::

The strong bounce in bitcoin over the weekend occurred as shorts covered positions.

(*8cd8d197*)::

Cryptocurrency market makers say they’re fielding inquiries about how to bet on a falling price for the dollar-pegged stablecoin USDT.

— Bitcoin Climbs Past $40K for First Time Since Mid-June – CoinDesk

— Bitcoin was up for a sixth straight day, surging 17% over the past 24 hours to climb out of a months-long range between $30,000 and $40,000.

(*8cd8d197*)::

Deep negative real returns on bonds tend to boost the attractiveness of other assets.

— USDT Maintains Dollar Peg as Traders Shrug Off DOJ Tether Probe Report – CoinDesk

— Unlike past scares, Monday’s report of a Department of Justice investigation hasn’t shaken traders’ faith in the stablecoin.

— Tether’s Collapse Would Be Chaotic, Not Cataclysmic | David Z. Morris – CoinDesk

— Possible criminal charges against Tether executives will put even more pressure on a product that the market is already cooling on.

(*8cd8d197*)::

Funding will go toward three main areas including hiring, marketing as well as business and product development.

— Bitcoin Climbs Past $40K for First Time Since Mid-June – CoinDesk

— Bitcoin was up for a sixth straight day, surging 17% over the past 24 hours to climb out of a months-long range between $30,000 and $40,000.

(*8cd8d197*)::

The a16z-backed Eco, where users’ deposits are loaned out in USDC, says it’s keeping an eye on the BlockFi case.

— Market Wrap: Bitcoin Spike Points to Potential Trend Reversal – CoinDesk

— Bitcoin (BTC) could be set for a reversal of a downtrend since April after a strong short-squeeze pushed price near $40K resistance.

— Tether’s Collapse Would Be Chaotic, Not Cataclysmic | David Z. Morris – CoinDesk

— Possible criminal charges against Tether executives will put even more pressure on a product that the market is already cooling on.

— The Tether Put: Crypto Equivalent of Credit Default Swap? – CoinDesk

— Cryptocurrency market makers are fielding inquiries about how to bet on a falling price for the dollar-pegged stablecoin USDT.

(*8cd8d197*)::

Congress is holding three simultaneous hearings around cryptocurrencies today – and they’re all on different types of use cases.

(*8cd8d197*)::

The short-term put-call skews have pulled back due to a flurry of call buying.

— Bitcoin Spikes on Short Squeeze, Shrugs Off Tether News – CoinDesk

— Crypto market analysts say the latest spike in the price of bitcoin ($BTC) may have been fueled by a short squeeze.

— Bitcoin Takes a Breather as Stocks Drop, Inflation-Adjusted Bond Yields Hit Record Low – CoinDesk

— After rallying for five consecutive days, bitcoin is taking a breather alongside a dour mood in traditional markets.

(*8cd8d197*)::

With the crypto markets stabilizing after a recent short squeeze and a look at how crypto developers are spending more time optimizing than innovating, CoinDesk’s Markets Daily is back with the latest news roundup.

— Market Wrap: Bitcoin Spike Points to Potential Trend Reversal – CoinDesk

— Bitcoin (BTC) could be set for a reversal of a downtrend since April after a strong short-squeeze pushed price near $40K resistance.

(*8cd8d197*)::

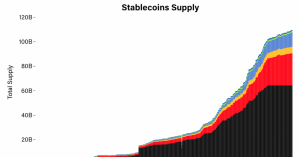

From questions surrounding Tether’s USDT to Circle’s plan to go public, here is your guide to why everyone is suddenly talking about stablecoins.

— The Tether Put: Crypto Equivalent of Credit Default Swap? – CoinDesk

— Cryptocurrency market makers are fielding inquiries about how to bet on a falling price for the dollar-pegged stablecoin USDT.

— Solana’s Saber Labs Raises $7.7M in Seed Funding Round Led by Race Capital – CoinDesk

— Saber, built atop the Solana protocol, is a cross-chain decentralized exchange and automated market maker platform based around stablecoins.

(*8cd8d197*)::

Technical data suggests lower support around $34,000 could stabilize the current pullback.

— Bitcoin Takes a Breather as Stocks Drop, Inflation-Adjusted Bond Yields Hit Record Low – CoinDesk

— After rallying for five consecutive days, bitcoin is taking a breather alongside a dour mood in traditional markets.

(*8cd8d197*)::

Uniswap’s removal of a set of assets from its interface has the community asking just how decentralized is the platform.

— Solana’s Saber Labs Raises $7.7M in Seed Funding Round Led by Race Capital – CoinDesk

— Saber, built atop the Solana protocol, is a cross-chain decentralized exchange and automated market maker platform based around stablecoins.

— Crypto Fintech Eco Raises $60M for High-Yield USDC Savings App – CoinDesk

— Eco is raising another $60 million to propel its early hit stablecoin crossover as regulators turn up the pressure on the sector.

(*8cd8d197*)::

Data underscores that It’s not that easy to win over a crypto trader’s heart.

— Crypto Fintech Eco Raises $60M for High-Yield USDC Savings App – CoinDesk

— Eco is raising another $60 million to propel its early hit stablecoin crossover as regulators turn up the pressure on the sector.

(*8cd8d197*)::

Analysts expect bitcoin to pause at around $40K before its next leg up.

(*8cd8d197*)::

Users can now open USDC positions and stake CVI USDC through the index.

— Bitcoin, Ether Options Markets Pare Bearish Bias – CoinDesk

— The short-term put-call skews on both bitcoin and ether have pulled back due to a flurry of call buying, amid the latest rally in crypto.

— Congress’ 3 Crypto Hearings Promise Substance – CoinDesk

— Congress is holding three simultaneous hearings centered around cryptocurrency today. They all promise to be fairly substantive.

(*8cd8d197*)::

In digital assets, high yields are ubiquitous, but it’s not always clear what risks are actually taken to generate these yields, says our columnist.

— Bitcoin, Ether Options Markets Pare Bearish Bias – CoinDesk

— The short-term put-call skews on both bitcoin and ether have pulled back due to a flurry of call buying, amid the latest rally in crypto.

— Crypto News Roundup for July 27, 2021 – CoinDesk

— With the crypto markets stabilizing after a recent short squeeze and a look at how crypto developers are spending more time optimizing than innovating, CoinDesk’s Markets Daily is back with the latest news roundup.

— Congress’ 3 Crypto Hearings Promise Substance – CoinDesk

— Congress is holding three simultaneous hearings centered around cryptocurrency today. They all promise to be fairly substantive.

(*8cd8d197*)::

Recent regulatory developments could push stablecoins closer to the existing fiat system, unleashing competition for control over a lifeblood of the crypto industry, says our columnist.

— Market Wrap: Bitcoin Stalls After Short-Squeeze Rally – CoinDesk

— Bitcoin is down about 4% over the past 24 hours. But support around $34,000 could stabilize the current pullback.

— Crypto News Roundup for July 27, 2021 – CoinDesk

— With the crypto markets stabilizing after a recent short squeeze and a look at how crypto developers are spending more time optimizing than innovating, CoinDesk’s Markets Daily is back with the latest news roundup.

— How Decentralized Is DeFi? – CoinDesk

— Uniswap’s removal of a set of assets from its interface has the community asking just how decentralized is this DeFi platform.

— Traders, Unswayed by Axie Infinity Hype, Are Aggressively Shorting AXS – CoinDesk

— Data underscores that It’s not that easy to win over a crypto trader’s heart.

— Market Wrap: Bitcoin Expected to Pause Before Next Rally – CoinDesk

— Analysts expect bitcoin (BTC) to pause around $40K resistance before the next leg up. Sentiment is approving, but appears overbought.

— Why Stablecoins Are Suddenly in the News – CoinDesk

— There’s much going on about stablecoins at the moment. Some of it can be overwhelming. Here are the three big things happening right now.

— Parsing 3 Types of Risk in Digital Assets | Jeff Dorman – CoinDesk

— In digital assets, high yields are ubiquitous, but it’s not always clear what risks are actually taken to generate these yields, says our columnist.

— Crypto Volatility Index 2.0 Rolled Out With USDC Support – CoinDesk

— COTI has launched a revamped version of Crypto Volatility Index (CVI) offering a set of features including USDC support for staking.

— Why Stablecoins Are Suddenly in the News – CoinDesk

— There’s much going on about stablecoins at the moment. Some of it can be overwhelming. Here are the three big things happening right now.

— Stablecoin Regulation Leads to Geopolitical Rivalry | T Ratna – CoinDesk

— Recent regulatory developments could push stablecoins closer to the fiat system, unleashing competition for control over a lifeblood of the crypto industry, says our columnist.

— Market Wrap: Bitcoin Stalls After Short-Squeeze Rally – CoinDesk

— Bitcoin is down about 4% over the past 24 hours. But support around $34,000 could stabilize the current pullback.

— How Decentralized Is DeFi? – CoinDesk

— Uniswap’s removal of a set of assets from its interface has the community asking just how decentralized is this DeFi platform.

— Traders, Unswayed by Axie Infinity Hype, Are Aggressively Shorting AXS – CoinDesk

— Data underscores that It’s not that easy to win over a crypto trader’s heart.

— Market Wrap: Bitcoin Expected to Pause Before Next Rally – CoinDesk

— Analysts expect bitcoin (BTC) to pause around $40K resistance before the next leg up. Sentiment is approving, but appears overbought.

— Crypto Volatility Index 2.0 Rolled Out With USDC Support – CoinDesk

— COTI has launched a revamped version of Crypto Volatility Index (CVI) offering a set of features including USDC support for staking.

— Parsing 3 Types of Risk in Digital Assets | Jeff Dorman – CoinDesk

— In digital assets, high yields are ubiquitous, but it’s not always clear what risks are actually taken to generate these yields, says our columnist.

— Stablecoin Regulation Leads to Geopolitical Rivalry | T Ratna – CoinDesk

— Recent regulatory developments could push stablecoins closer to the fiat system, unleashing competition for control over a lifeblood of the crypto industry, says our columnist.