Fri Feb 14 00:05:27 2020

<8f79fcda>

<9e126bf3> <@U8F8V823B> well one thing that is interesting is that accredited investor private placements are allocated according to NAV and not share price. There’s a pretty hefty premium on the share price for all their publicly traded funds… I think they are locked in for a time period though so they can’t just dump on retail. Think about it though, right now $ETCG is trading at like 75% premium, so not only do you get the upside of $ETC but you also get that extra juice. Pays to have money :money_mouth_face:

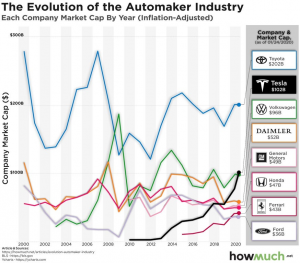

<9e126bf3> <@U036M05JL> I wonder how the inflation adjustment works… the great recession looks like a non-event in that chart somehow… look at Ford- recession was good for them :joy:

<9e126bf3> I wonder what Henry Ford would think of Musk crushing Ford market cap in a decade

<8f79fcda> yea, ford didn’t take any money in the bailout. inflation adjusted is usually a CPI number +/- x

<8f79fcda> if henry ford were alive, he’d be like musk

<9e126bf3> Yeah I suppose you’re right

<9e126bf3> but would he date Grimes?